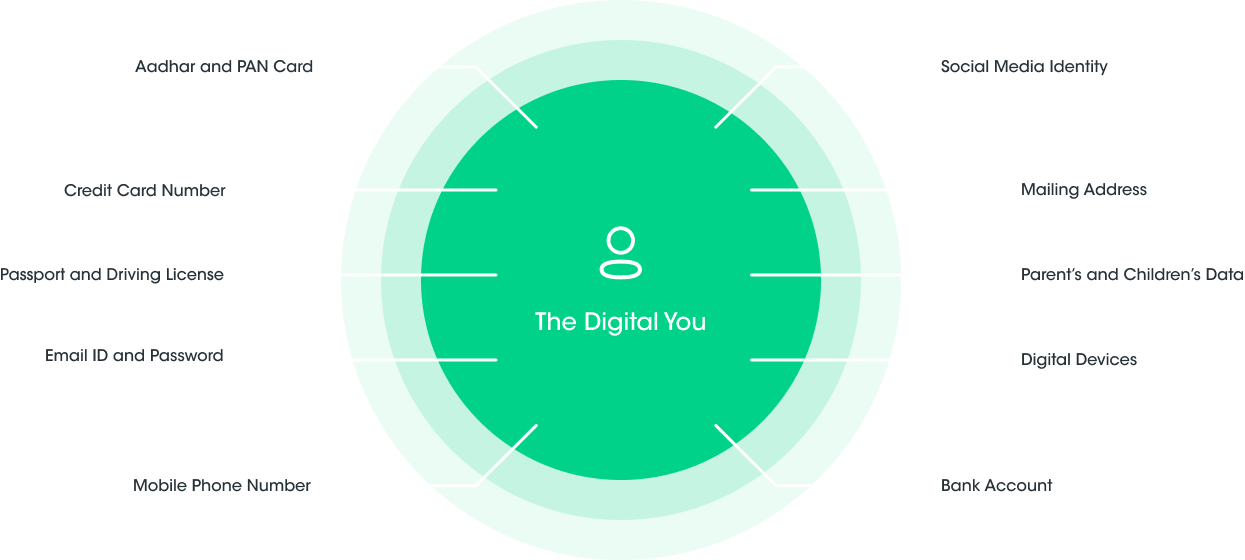

Components of your digital identity

What are the threats to your digital identity?

Be aware of the identity thieves lurking in the digital ecosystem. They can exploit the Digital You and steal your information for misuse.

Drain your accounts

Thieves can steal your financial information, withdraw money in your name or make large purchases from your bank account.

Open new accounts

After capturing & linking your KYC and digital access controls, they will create parallel accounts & apply for loans, credit cards & more.

Destroy credit records

Upon deleting your financial well-being, they will ruin your credit reputation that was carefully built over time.

Clone your digital identity

To duplicate your identity, they will shadow & clone your social media accounts, mobile numbers & government issued identity documents, without your knowledge.

Account breach

Your device or network can be attacked to extract all your confidential information.

Dumpster diving

Someone could be looking for treasure in your trash to uncover sensitive information.

Malicious softwares

Under a malware attack, the data in your PC could be stolen, encrypted or even deleted.

Phishing

Your one wrong click on a spam link or a message can give thieves access to your private data.

Who is at risk of digital identity theft?

Social media users

Social media users are at growing risk of identity theft. Since the main motive of social media is to share information with large number of people, it has become great source of identity theft. Basic information like, name, date of birth, hometown or mobile number is more than enough for a thief to create your fake identity.

Smartphone Users

Smart phone users are opening doors to identity thieves since most of our personal data is stored digitally. Given that an ever increasing number of people are using smartphones for all financial transactions including paying bills and money transfer, they have become a hot target for identity thieves.

Credit Card Users

Ever since people started becoming a part of cashless economy, rate of identity theft began to increase simultaneously. Rising use of credit and debit cards, made easy for identity thieves to steal and misuse financial data. Data can be compromised either by physical stealing of credit card or through other smart tricks like skimming, data breaches, etc.

High Net Worth Individuals

The more you have to protect, the less proficiently you protect. Money and wealth are the most important factors in identity theft. Wealthy and rich people usually have number of bank accounts which make their information available through various sources. This gives multiple choices to an identity thief to compromise on their identity.

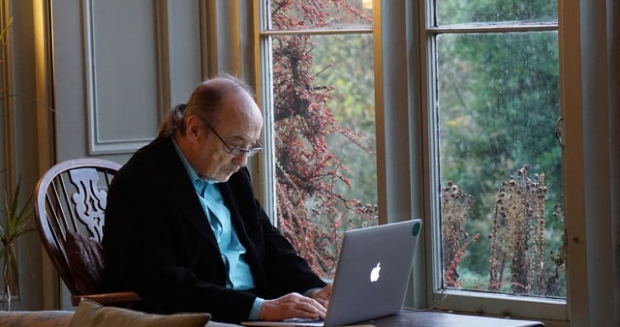

Senior Citizens

Senior citizens are more likely to fall victim to identity theft as they are usually not well familiar with technology. Identity thieves, taking advantage of this, easily manipulate and steal data from them. Also, it takes time for this fraud to come into light due to lack of technological knowledge and digital fraud awareness in senior citizens.

How does Cyberior work?

By constantly scanning and monitoring your key information we keep you protected through our globally acclaimed digital identity protection program.

- 1

- 2

- 3

- 4

- 5

-

Enroll

Investing your few minutes can protect your priceless endeavors for life.

-

Setup your watchlist

Cyberior keeps an eye on your digital identities for protection.

-

We monitor and detect threats

Cyberior constantly tracks your digital activity, detects risk and keeps your devices always secure.

-

You will be alerted

Get an instant alert in case of any suspicious activity in order to avoid the damage.

-

We will help you resolve and reimburse

Cyberior digital protection helps you to restore your identity. And also assists in resolving and recovering the financial loss, if any.